option to tax 20 years

Therefore the signNow web application is a must-have for completing and signing revoke an option to tax after 20 years have passed gov on the go. The option will automatically lapse if no interest is held on the property for over six years.

R1 M6 Employee Stock Options Flashcards Quizlet

Essentially speaking an option to tax lasts indefinitely but there is then the option to revoke it after 20 years.

. The option to tax will apply to all future supplies that are made in respect of the land building. The option can be revoked 20 years after it was made. Use this form if you want to revoke an option to tax land or buildings where more.

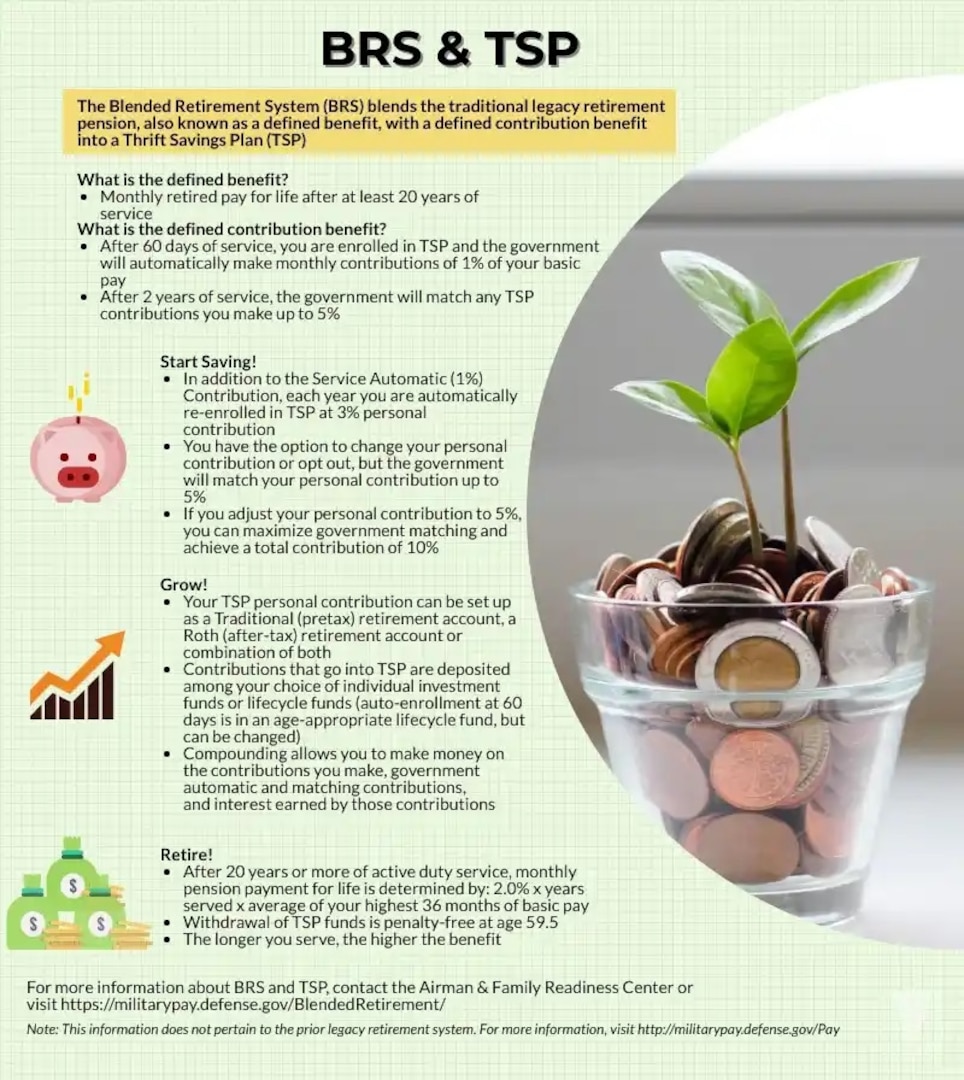

An important feature of the option to tax regulations is that they apply to a property for a 20-year period once an election has been made by a business. You can revoke your option to tax after 20 years by completing a form VAT 1614J. The option to tax allows a business to charge VAT on the sale or rental of commercial property or in other words to make a taxable supply from what otherwise would.

O Section 11012 relating to the limitation on losses for taxpayers other than. So for example if an option to tax were applied over a commercial building all of the rents the. The option to tax election can now be revoked if 20 years have passed since the election was made in respect of the building.

60 of the gain or loss is taxed at the long-term capital tax rates. Will have a zero balance. In Neils next article for.

Revoking an option to tax after 20 years. VAT1614J Page 1 HMRC 0520 Opting to tax land and buildings. Conditions for revoking an option to tax when more than 20 years have elapsed since the option first had effect for the purposes of paragraph 251a of Schedule 10 to the.

Property VAT and option to tax can be a challenging area. 40 of the gain or loss is taxed at the short-term capital tax. Option to tax generally has no effect on the.

An important feature of the option to tax. Taylor purchases an October 2020 put option on Company XYZ with a 50 strike in May 2020 for 3. O Section 11011 relating to the 20 deduction for domestic qualified business income.

The option to tax rules were introduced on 1 August 1989 so with each day that passes more elections will have passed the 20 year time period. Before you can revoke the option to tax without having to obtain prior permission from HMRC you have to. If youre not able to pay the.

Section 1256 options are always taxed as follows. In order to revoke an option you must. However once that 20.

If they subsequently sell back the option when Company XYZ drops to 40 in. An important feature of the option to tax regulations is that they apply to a property for a 20-year period once an election has been made by a business. This may include among other costs professional fees and rent under a lease for a term of 21 years or less in.

In a matter of seconds receive an. However this is not automatic.

Coast Guard Financial Readiness Training What It Means To Be Vested In The Thrift Savings Plan Tsp United States Coast Guard My Coast Guard News

Vat5l Fill Out And Sign Printable Pdf Template Signnow

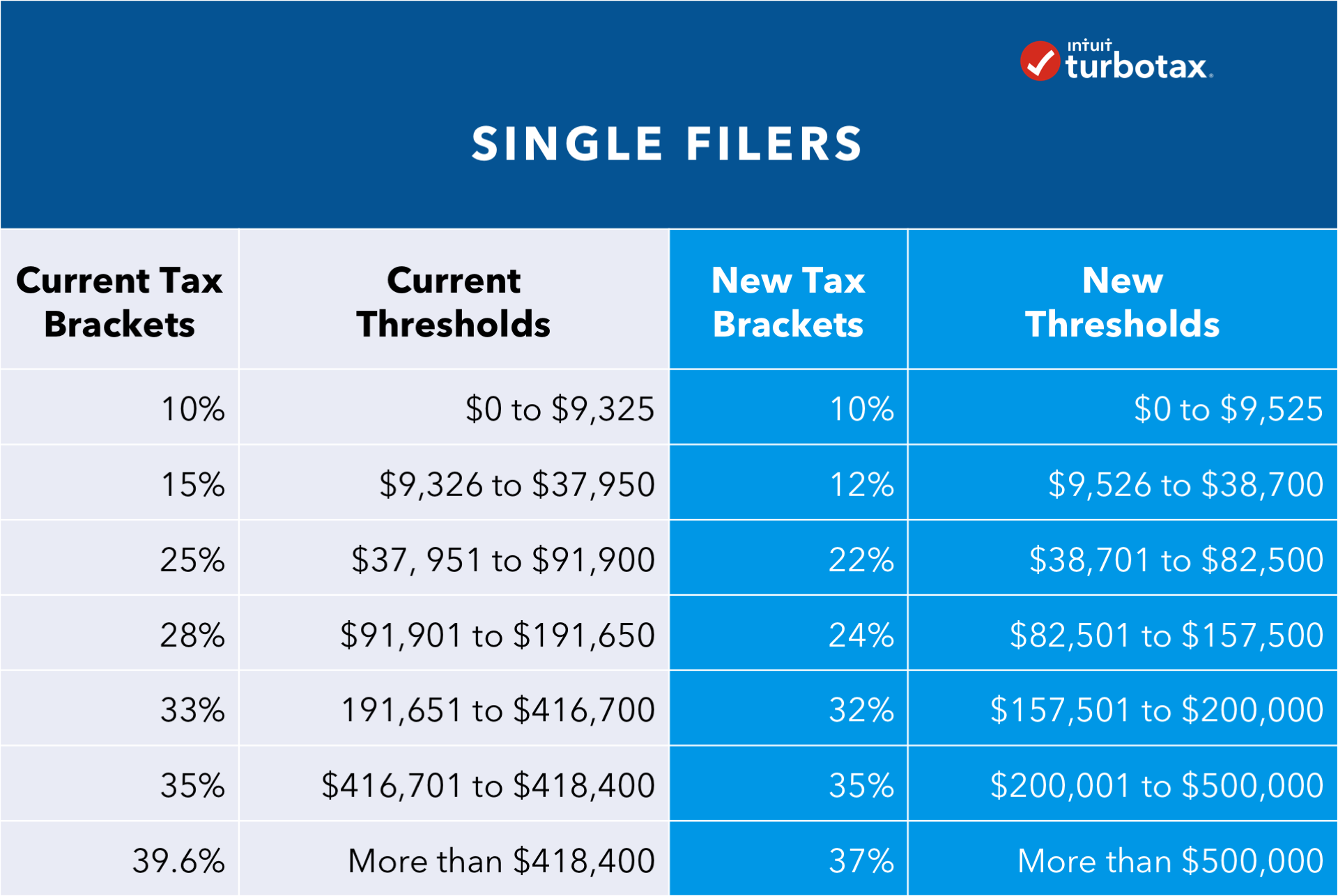

Tax Reform Impact What You Should Know For 2019 Turbotax Tax Tips Videos

September 25 2020 Mount Pleasant Special Town Council Meeting Youtube

Vat And Property What Is An Option To Tax And Why Does It Matter

Vat1614a Fill Out And Sign Printable Pdf Template Signnow

Back To The Drawing Board For Tax Reform But This Time Without Food Tax Hike Kutv

The Tax Help Guide Ultimate Resource For Tax Help Questions

Six Changes Every Tax Reform Plan Should Include Tax Foundation

Six Changes Every Tax Reform Plan Should Include Tax Foundation

Pdf Dual Income Taxation A Promising Path To Tax Reform For Developing Countries Semantic Scholar

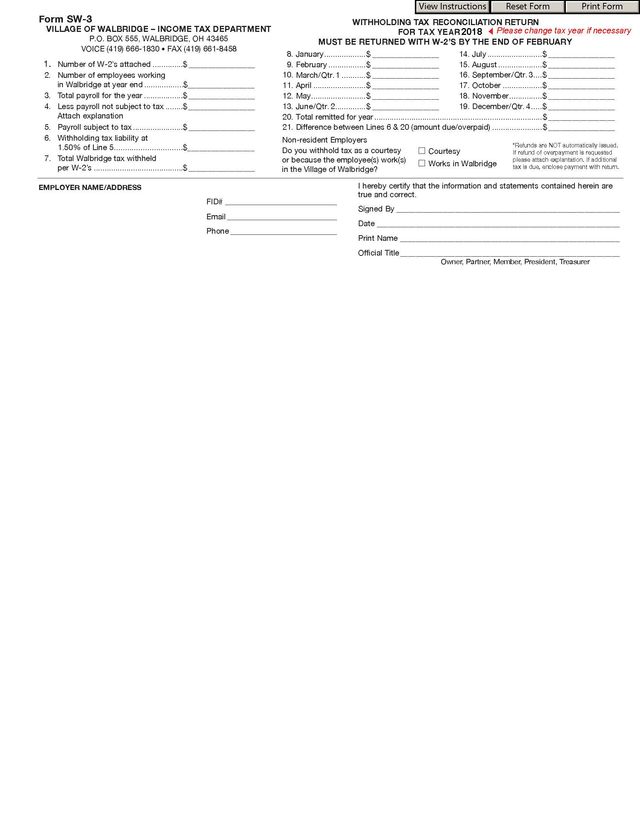

Village Of Walbridge Ohio Tax Forms

Can We Fix The Debt Solely By Taxing The Top 1 Percent Committee For A Responsible Federal Budget

A Preview Of Covid 19 Stimulus Bill Henry Horne

Tax Corner Revoking An Option To Tax On Property The Irish News

Page 67 Fy 2020 21 Revenue Outlook

What Taxpayers Must Know About The Irs 10 Year Statute Of Limitations Landmark Tax Group

Modifications To The 10 Year Gain Exclusion Option Open The Door For Multi Asset Funds Novogradac